Weak Hiring and Mortgage Markets Test Equifax (EFX) as Q4 Growth Shows Resilience

Equifax shares are edging higher as a 23-day seasonal window with a positive long-term tilt overlaps with fresh evidence of resilience in its core businesses.

Key takeaways

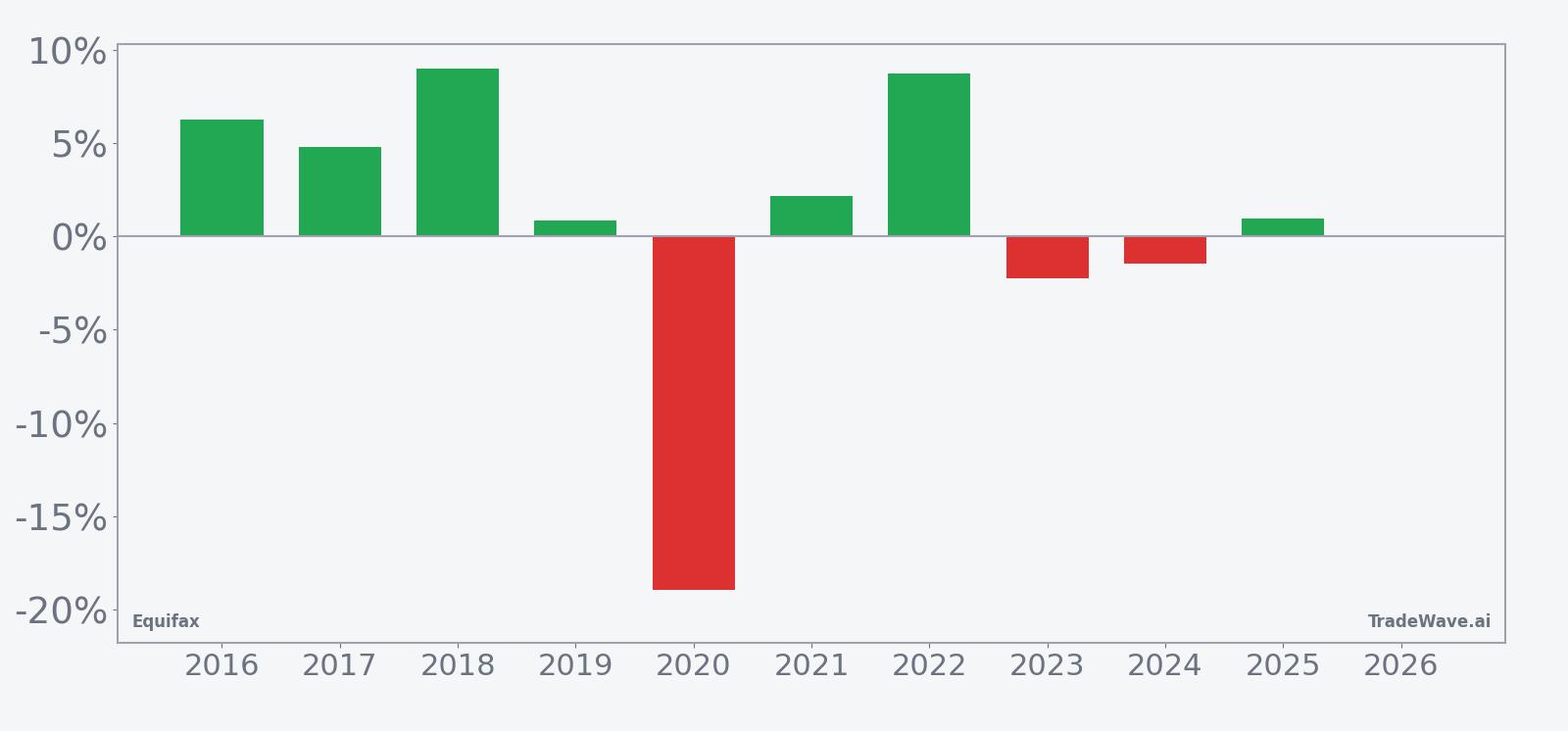

- Equifax is in a 23-day seasonal window starting Feb 21 that has historically favored the long side, with 7 winning years and 3 losing years over the past decade.

- The pattern shows 70% of years ending positive, with average gains of 4.68% in winning years and a more modest 1% average when all years are included.

- Historical paths feature meaningful swings, including a maximum favorable move of 10.59% in one year and a maximum adverse move of -24.16% in another, underscoring intraperiod volatility.

- The seasonal tendency arrives as Equifax trades at $197.46 following Q4 results that showed revenue growth despite weak hiring and mortgage markets.[1]

- Industry disruption from FICO’s new pricing model remains a medium-term overhang, but the current window has often coincided with constructive price action for Equifax in prior years.[14]

According to historical data from TradeWave.ai, this late-February stretch has shown a distinct seasonal bias for Equifax in recent years. The following section unpacks how that backdrop compares with today’s fundamental and industry context.

Seasonal window

This seasonal window is currently underway, spanning 23 days, and has historically been a constructive stretch for Equifax. The stock closed at $197.46 on Feb 21, up 1.1% on the day, leaving it in the middle of its recent trading range rather than pressing either a 52-week high or low.[1]

With a long trade direction, the pattern is defined by years in which Equifax has tended to grind higher over the 23-day span. Across the past 10 years, 70% of these windows finished positive, with 7 winners and 3 losers, which gives the setup a constructive but not one-sided profile. Average gains of 4.68% in winning years compare with a 1% average when all years, including the three down periods, are taken together, highlighting how a handful of weaker episodes has pulled down the overall result.

The distribution of outcomes shows both steady advances and sharp setbacks. The strongest year in the sample was 2018, when Equifax gained 8.98% during the window, helped by a maximum favorable move of 10.59% from the entry level before giving back a small portion of those gains by the close. At the other extreme, 2020 stands out as the weakest year, with a net loss of 18.97% and a maximum adverse move of -24.16% from the starting price, illustrating how quickly conditions can deteriorate even inside a generally positive seasonal phase.

The historical path of returns within the window tends to show a modest upward bias rather than a straight-line climb. In several years, including 2016, 2017 and 2022, the stock advanced early and then consolidated, while in others, such as 2019 and 2025, the net result was close to flat despite intraperiod swings. That mix is reflected in the relatively low Sharpe ratio of 0.1, which indicates that risk-adjusted returns based on end-of-window outcomes have been modest even as the raw win rate has been solid.

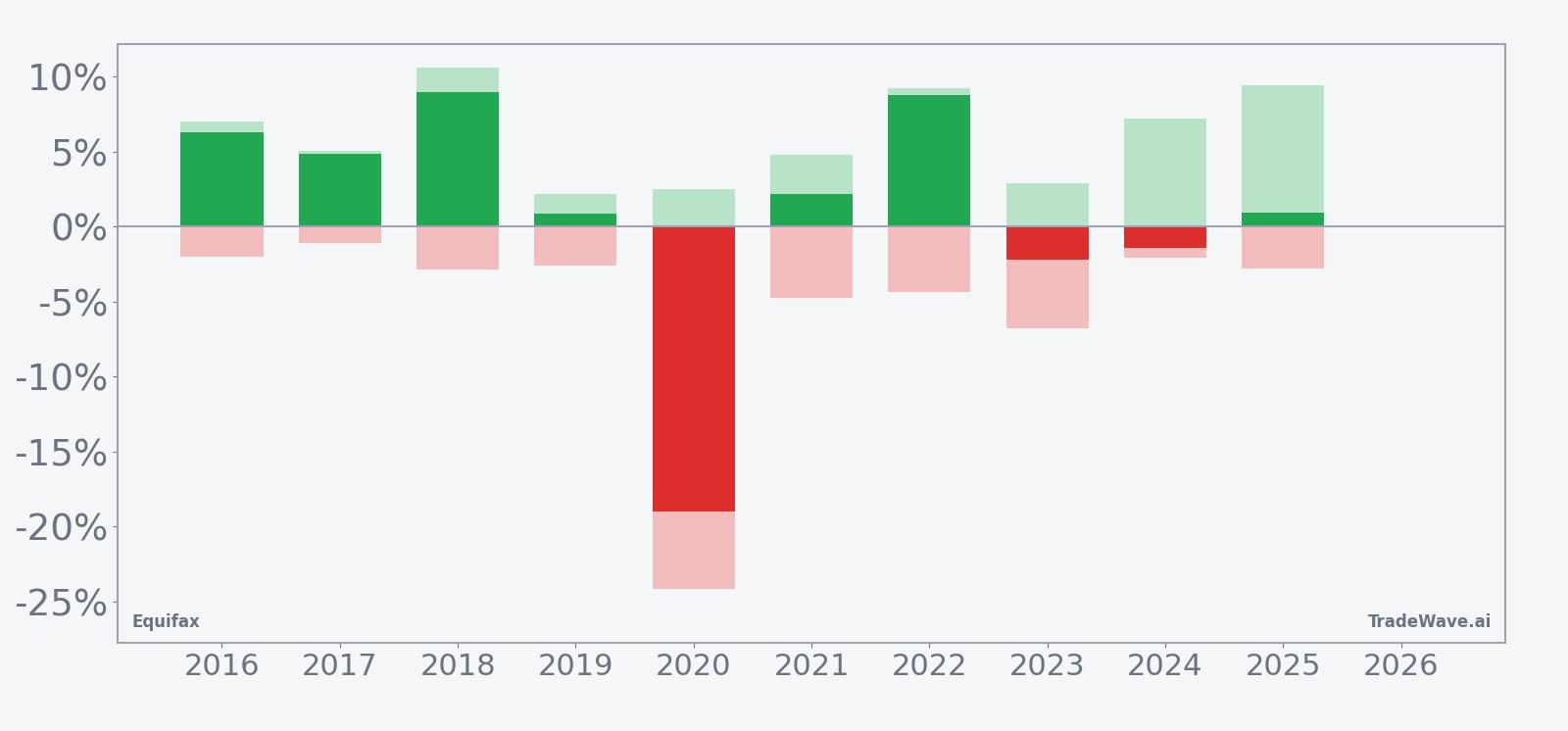

A combined view of net results with peak favorable and worst adverse moves helps frame the trade-off between upside potential and drawdown risk.

The bar chart that pairs net returns with peak favorable and worst adverse moves underscores that even in winning years, Equifax has often experienced notable drawdowns before finishing higher. For example, 2024 delivered a small net loss of -1.44% despite a maximum favorable move of 7.19%, while 2023 saw a net decline of -2.23% after a 2.9% run-up and a -6.81% pullback from the starting level. Taken together, the historical pattern defines the quantitative seasonal backdrop for the current period.

History does not guarantee future results; adverse excursions (MAE) can be large even in winning windows.

Price and near-term drivers

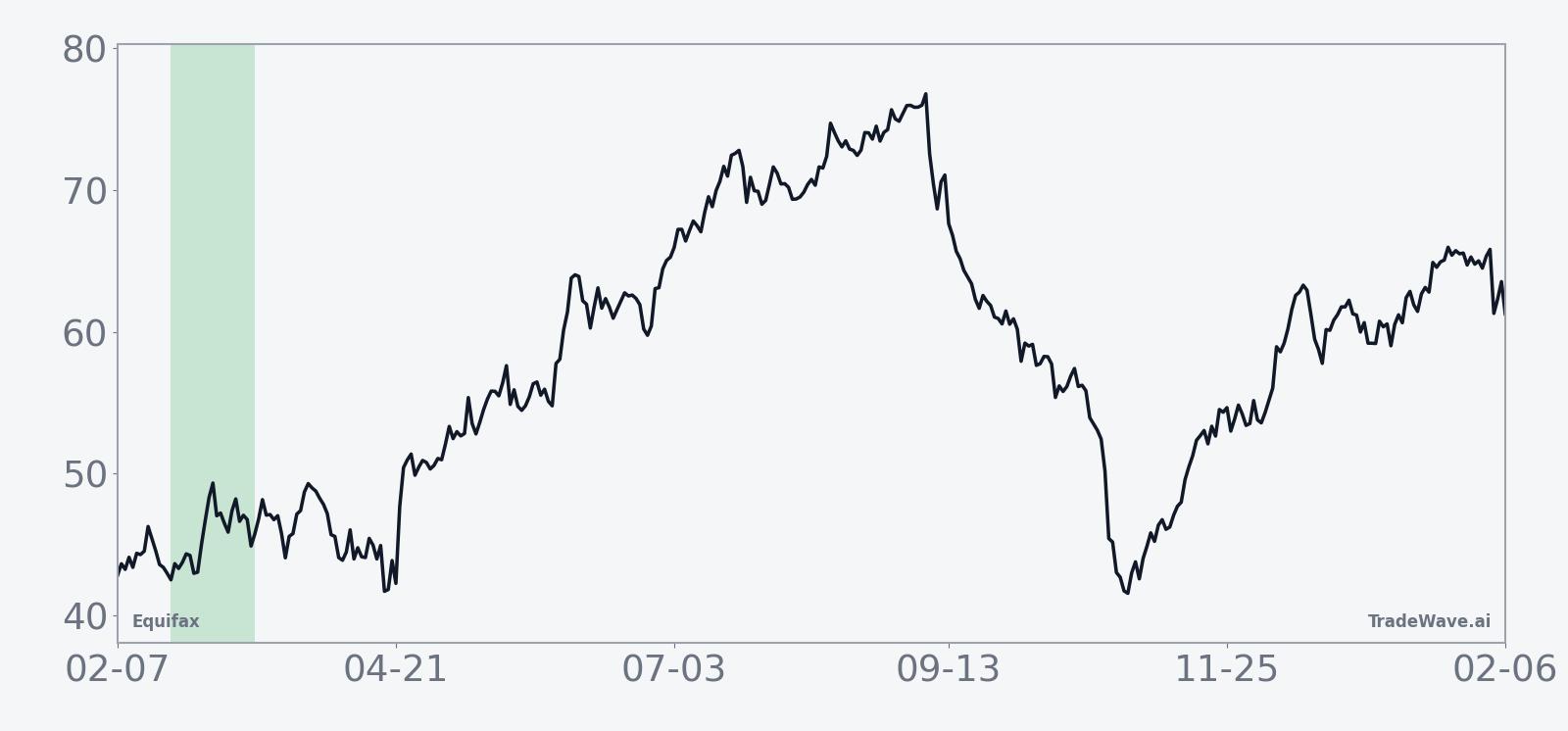

Equifax shares finished Friday at $197.46, up 1.1% on the session, as investors continued to digest early-February earnings that showed the company growing through a soft macro backdrop.[1] The move leaves the stock trading in the middle of its recent 12-month range, with no clear signal yet that the seasonal window is amplifying either bullish or bearish momentum.

The company’s most recent quarterly report on Feb 4 showed net income of $175.8 million, or $1.44 per share, up slightly from $174 million, or $1.39 per share, a year earlier.[1] Revenue growth was driven by a 20% jump in U.S. mortgage revenue and 9% growth in workforce solutions, even as broader hiring and housing markets remained weak, suggesting Equifax is finding pockets of demand despite cyclical headwinds.[1] Management did not provide formal forward guidance in the available text, leaving investors to infer the trajectory from segment trends rather than explicit targets.[1]

That resilience is playing out against a shifting competitive landscape in credit scoring. In Oct 2025, Fair Isaac introduced a new pricing model for mortgage lenders that bypasses traditional credit bureaus, a move that triggered an 8.44% drop in Equifax shares at the time and raised questions about the durability of some legacy revenue streams.[14] While that disruption is not front-page news in February trading, it remains part of the strategic backdrop as investors weigh how much of Equifax’s growth can come from newer data and analytics offerings rather than traditional credit files.

The chart below situates the latest move in its recent multi-month context.

Earnings and expectations

The latest quarter capped Equifax’s fiscal 2025 with a modest uptick in profitability, helped by strength in mortgage and workforce solutions that offset softness in other areas tied more directly to hiring and consumer credit formation.[1] The 20% increase in U.S. mortgage revenue is notable given the broader slowdown in housing activity, suggesting Equifax is either gaining share or benefiting from higher-value services per transaction.[1]

Workforce solutions, which grew 9%, continues to be a key pillar of the company’s diversification strategy, providing income and employment verification services that are less directly tied to traditional credit bureau volumes.[1] That segment’s performance is particularly important in light of the competitive pressure in core credit scoring, as it offers a path to more recurring, data-rich revenue streams that can support margins even when credit inquiries slow.

Street-level expectations for the next quarter and full year are not detailed in the available data, and there is no consolidated analyst rating or price target from a named provider in the research set. The absence of a clear consensus target leaves the stock trading more on realized fundamentals and thematic positioning than on a tightly defined valuation anchor from Wall Street models.

Macro and industry backdrop

Equifax’s recent performance has come against a macro environment characterized by weak hiring and mortgage markets, conditions that would typically weigh on credit bureaus and related financial data providers.[1] The company’s ability to grow revenue in that setting suggests some decoupling from pure volume trends, as it leans more heavily on analytics, verification services and differentiated data sets.

At the same time, the credit scoring industry is undergoing structural change. Fair Isaac’s new pricing model for mortgage lenders, introduced in Oct 2025, allows some customers to access scores without routing as much business through the traditional bureau infrastructure, challenging long-standing revenue arrangements for Equifax and its peers.[14] That shift has sharpened investor focus on how quickly Equifax can pivot toward products that are less exposed to commoditized score delivery and more tied to proprietary insights.

Equifax is navigating cyclical softness in hiring and housing while adapting to structural change in credit scoring, a combination that makes the current seasonal window a useful lens on how investors are reassessing the story.

For now, the macro narrative is one of gradual adjustment rather than abrupt dislocation. Weak hiring and mortgage activity remain headwinds, but they have not prevented Equifax from posting year-over-year growth in key segments, which may help explain why the stock is holding its ground as it moves through a historically constructive seasonal phase.[1]

Valuation context

Specific valuation markers such as price-to-earnings ratios, price-to-book multiples and dividend yield are not provided in the available data set, limiting direct comparison with peers on traditional metrics. In the absence of those figures, investors are likely focusing on the balance between Equifax’s demonstrated ability to grow through a soft macro patch and the strategic risk posed by industry disruption.

With no consolidated analyst rating or consensus price target from a named provider in the research, the stock’s current level near $197 can be viewed more as a market-derived assessment of that trade-off than as a tight convergence toward a published fair-value estimate. How Equifax trades through the remainder of this seasonal window, particularly around any incremental news on product strategy or competitive dynamics, may offer clues about whether investors are inclined to give the company the benefit of the doubt on its transition toward more analytics-driven revenue.

What to watch

For the remainder of this 23-day window, the key question is whether Equifax’s price action aligns with its historical tendency toward constructive, if sometimes volatile, performance. A continuation of steady gains or orderly consolidation after the recent bounce would be consistent with the 70% win rate seen in prior years, while a sharp reversal similar to 2020 or 2023 would underscore the downside scenarios embedded in the historical maximum adverse moves.

Traders and longer-term investors alike may focus on a few practical markers. First, how the stock behaves around any follow-up commentary on mortgage and workforce solutions will matter, given their outsized role in recent growth.[1] Second, any new signals about how Equifax is responding to FICO’s altered pricing model, whether through product launches or revised commercial terms, could influence sentiment on the durability of its core credit-related revenue streams.[14]

From a technical and seasonal standpoint, holding recent support levels while participating in broader market strength would fit the pattern of prior winning years, where early pullbacks were often followed by recoveries into the end of the window. Conversely, a break of near-term support accompanied by rising volume would look more like the weaker historical episodes, in which adverse moves deepened and were not fully retraced before the window closed.

Ultimately, the seasonal statistics provide a quantitative backdrop rather than a roadmap. The interplay between Equifax’s execution on its growth initiatives, the evolution of the credit scoring landscape and the stock’s behavior inside this historically constructive window will determine whether 2026 joins the majority of positive years or adds another data point to the minority of seasonal outliers.

Sources

- [1] The Wall Street Journal, “Equifax Revenue Rises Despite Weak Hiring, Mortgage Markets,” Feb 04, 2026.

- [14] The Wall Street Journal, “FICO Shakes Up Credit-Score Market,” Oct 02, 2025.